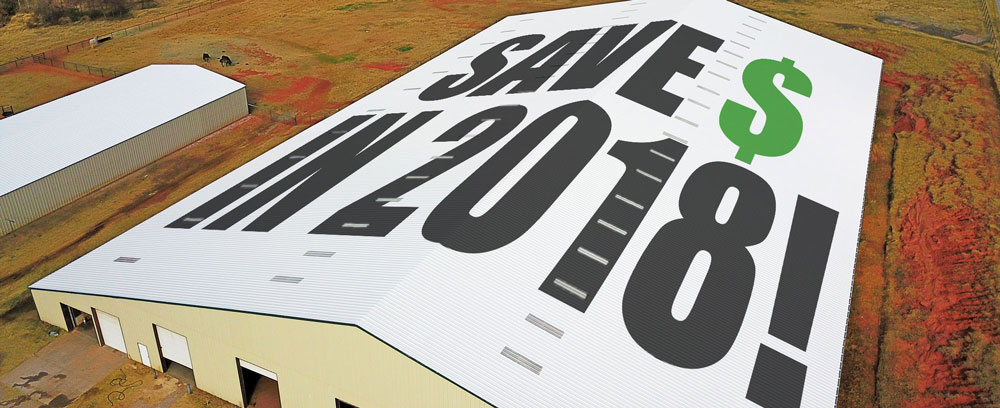

There has never been a better time to consider an improvement to your commercial structure’s roofing system. Not only are there better, more energy efficient, and longer lasting roofing systems available than ever before, but now, due to changes introduced by the Tax Cuts and Jobs Act there are great new tax advantages associated with commercial roofing projects starting in 2018.

Signed into law on Dec. 22, 2017, the new laws make some key changes to Internal Revenue Code Section 179. Section 179 allows taxpayers to immediately expense the cost of qualifying property against the current year’s earnings rather than recovering such costs over multiple years through depreciation.

There are several changes under the new law that directly lower the effective cost of commercial roofing projects for small businesses:

- Expands the definition of “qualified real property” to now include improvements to existing non-residential roofs, previously considered a “capital expenditure” not covered under Section 179.

- Small businesses are now able to deduct (in the year completed) the full cost of replacing a roof on an existing non-residential building instead of depreciating that cost over a 39-year period, as the previous law required.

- Expensing limits have increased from $500,000 to $1 million, and the phase-out threshold has been increased from $2 million to $2.5 million.

Given these changes, your small to mid-sized business may now elect to fully expense the cost of any improvements to nonresidential roofs beginning in 2018 and in future years. Essentially, any improvements to nonresidential roofs now may be expensed in the year of purchase.

This can have significant real-world savings for those businesses embarking on new roofing projects. For example, based on industry averages, the new policies shorten the average payback period on the cost of installing code-required insulation by 3.5 years: from 11.6 years to 8.1 years, a 21% net savings!

Of course, every business has unique tax considerations, so contact your tax professional if you have specific questions regarding how you can take advantage of the new laws.

Reference Links:

IRS website: “New rules and limitations for depreciation and expensing under the Tax Cuts and Jobs Act”.

More on IRC Section 179: http://www.section179.org