When you make the decision to build, rent, or lease a building for your commercial business, you have a lot of things to consider. You’ll have to acquire commercial insurance to protect your building, store, property, assets, roof, and so on. But how do you make that important decision?

When you make the decision to build, rent, or lease a building for your commercial business, you have a lot of things to consider. You’ll have to acquire commercial insurance to protect your building, store, property, assets, roof, and so on. But how do you make that important decision?

Look for Experience

There are many options for insurance for your business in Dallas, Texas, but don’t just pick anyone who offers insurance or who has the lowest price. Just like you would if you were hiring someone to put on a new roof — pay attention to their credentials.

Find an insurer who has experience in the industry, one who has seen the market trends come and go. These are the people who will tell you like it is.

Many “one-size fits all” insurance agents may try to sell you a policy that doesn’t match your needs. Make clear what you’re looking for and ask a lot of questions about their policies.

Choose a Business Insurer

You have life insurance and home insurance and car insurance and probably other types of insurance too. But that doesn’t mean you should necessarily buy your business insurance from the same place. That may make sense (especially if you get a multi-policy discount), but it might not.

An insurance agent who specializes in business/commercial insurance will usually give you more options and more reasonable coverage. They also specialize in business insurance, which means they stay abreast of what’s happening in their industry.

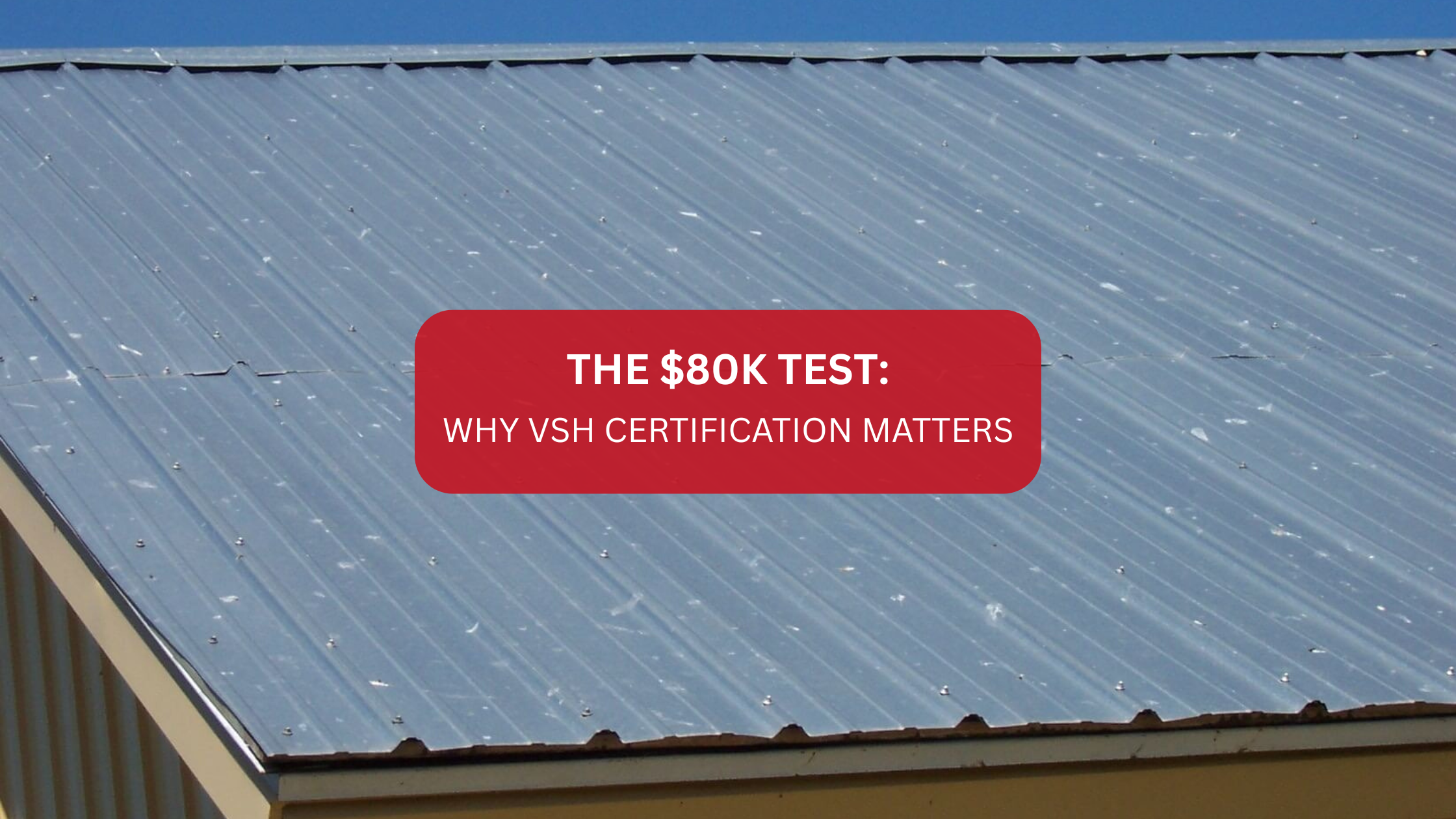

Ask About Liability Insurance

You’ll be looking for property/casualty insurance if you have a physical location (whether you’re renting or leasing in the Dallas area), but you should also ask about liability insurance. Liability insurance protects you in case someone should be injured or suffer any damages while on your property or if they are harmed by your business in another way.

Liability insurance is standard coverage that every business with a physical location should carry. What if there’s a storm and your roof ids damaged and parts of the roof are blown onto a car owned by one of your customers? What if someone slips and falls on your property and suffers an injury? Liability insurance is there to protect your business.

Plan for Growth

So, you have a building and property and you’re open for business. Now you insure that building and your assets and protect yourself with liability insurance. What are you going to do if business booms so much that you need to open a second or third location?

That’s a nice problem to have right?

Make sure you discuss your future plans with your insurance agent. Tell them how you plan to expand and grow. Are they capable of supporting you as your business grows? Are they large enough to offer growth in their offerings? Are they a business you can see yourself working with for years to come?